-

The revised EU Emissions Trading System calls for climate neutral basic materials by 2040 – this requires strong market demand from end-use sectors.

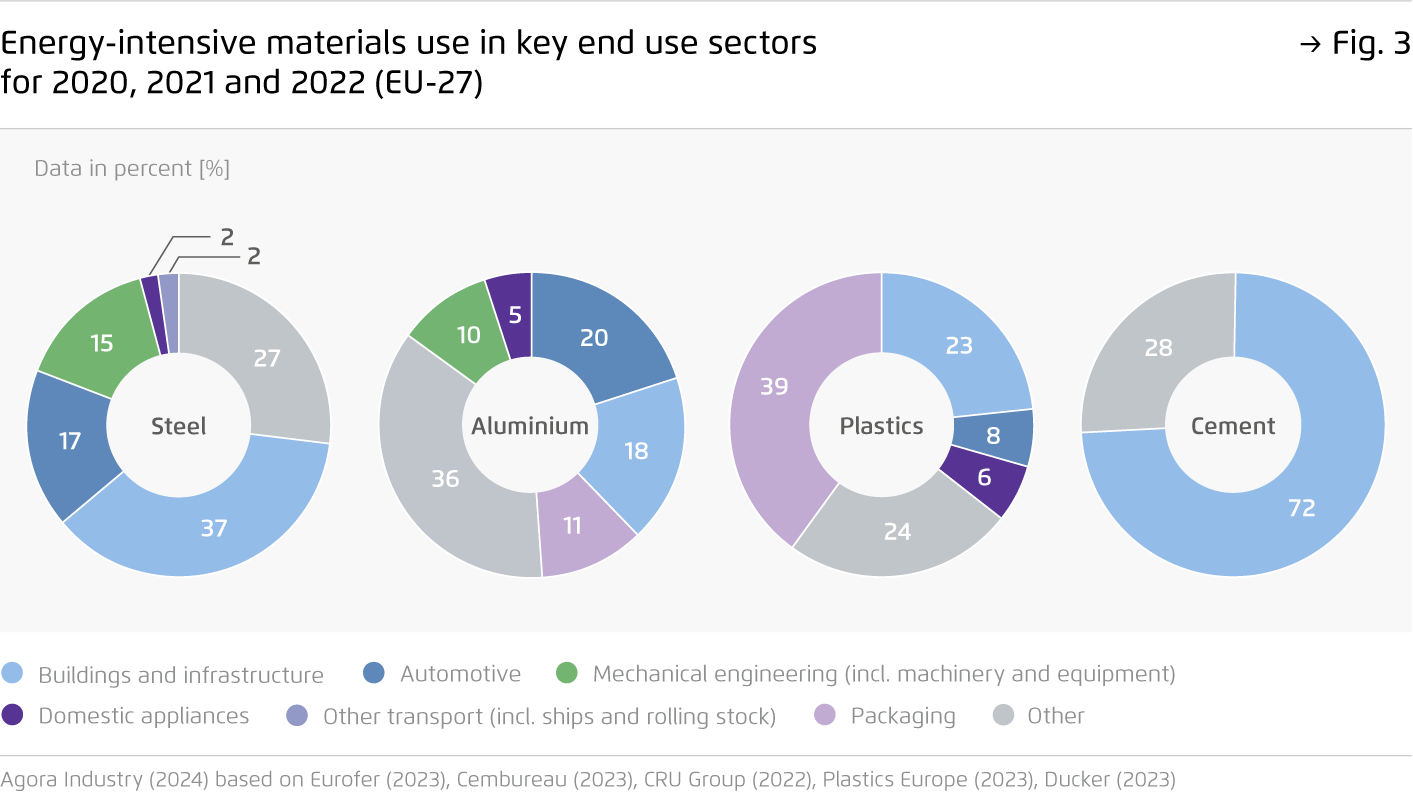

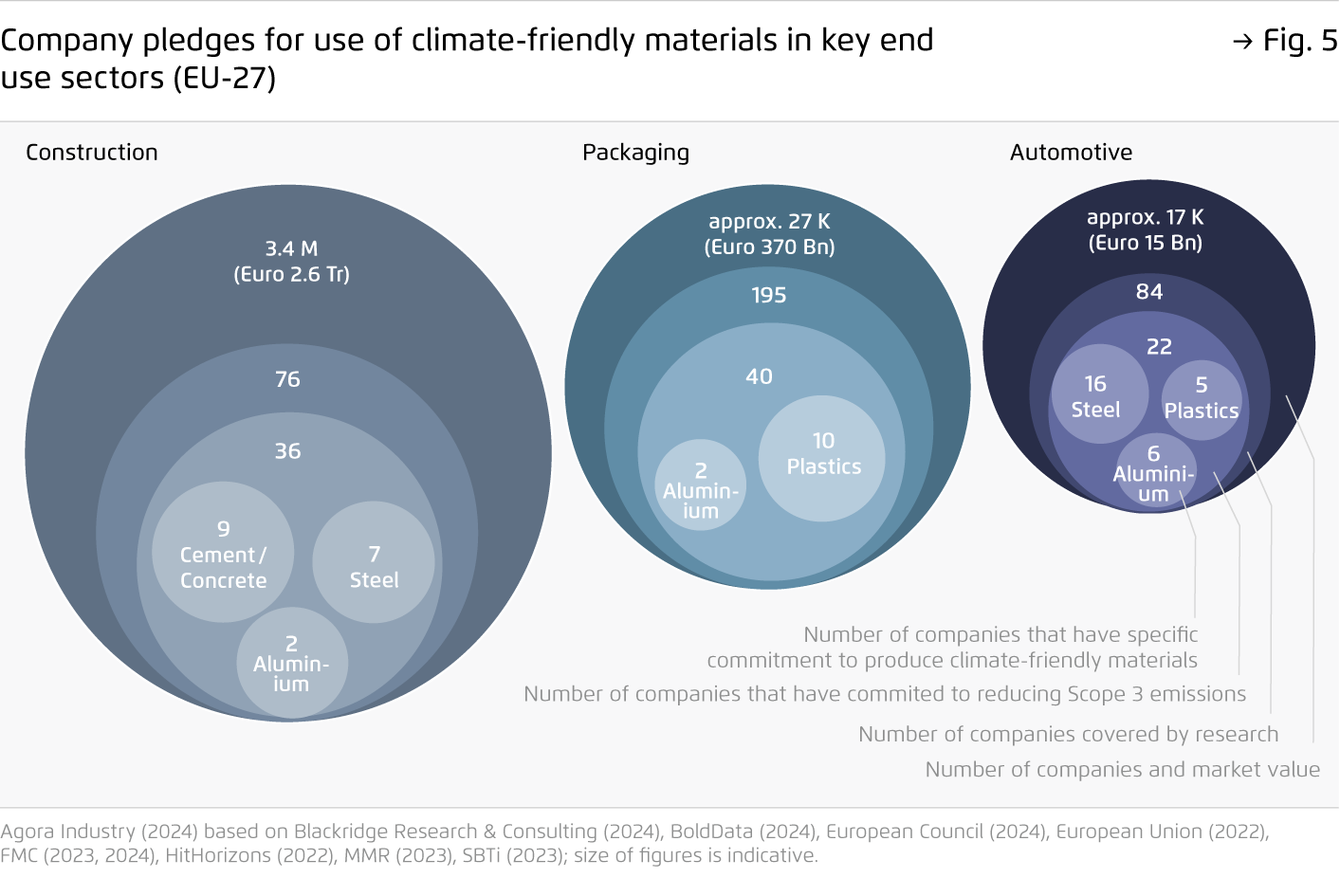

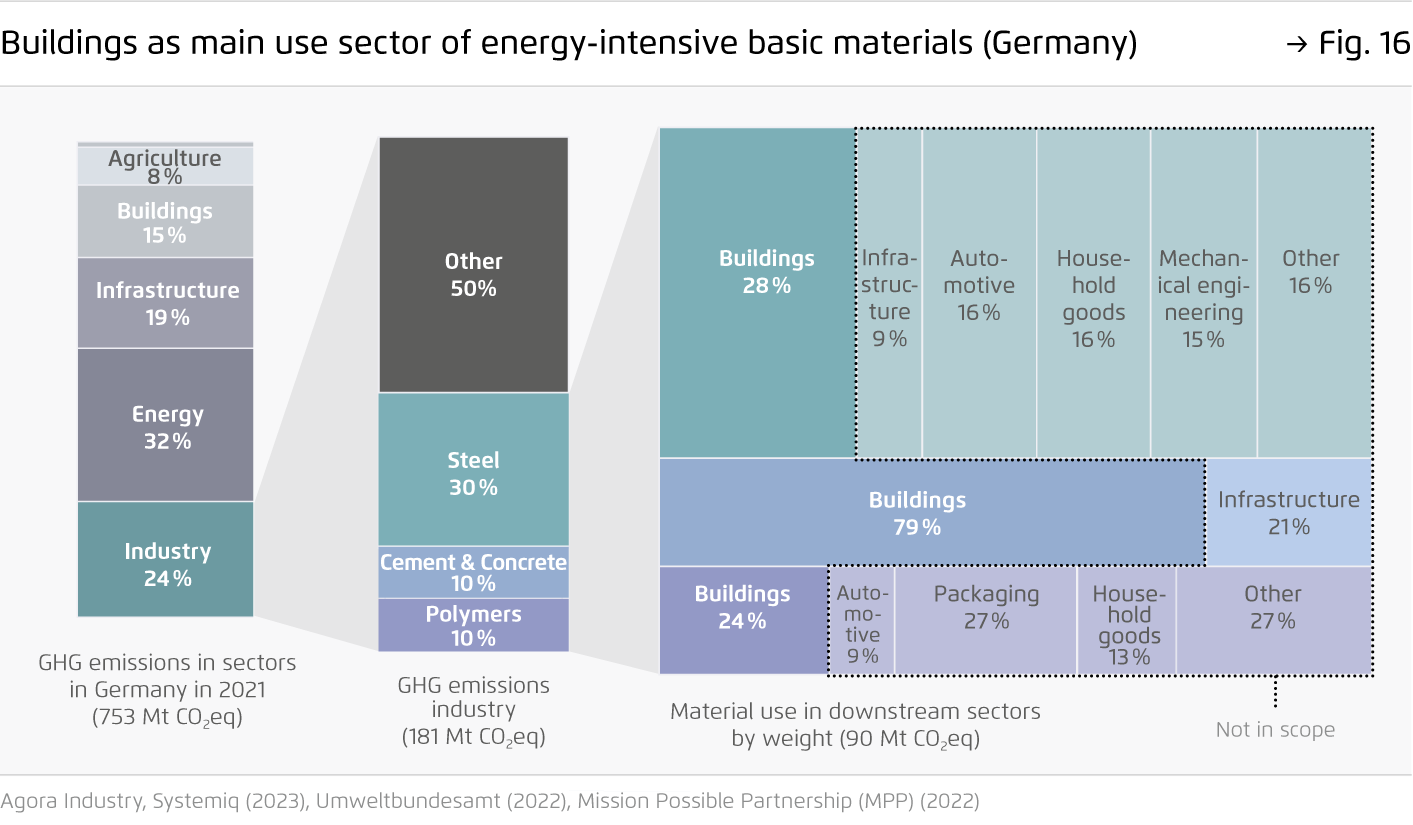

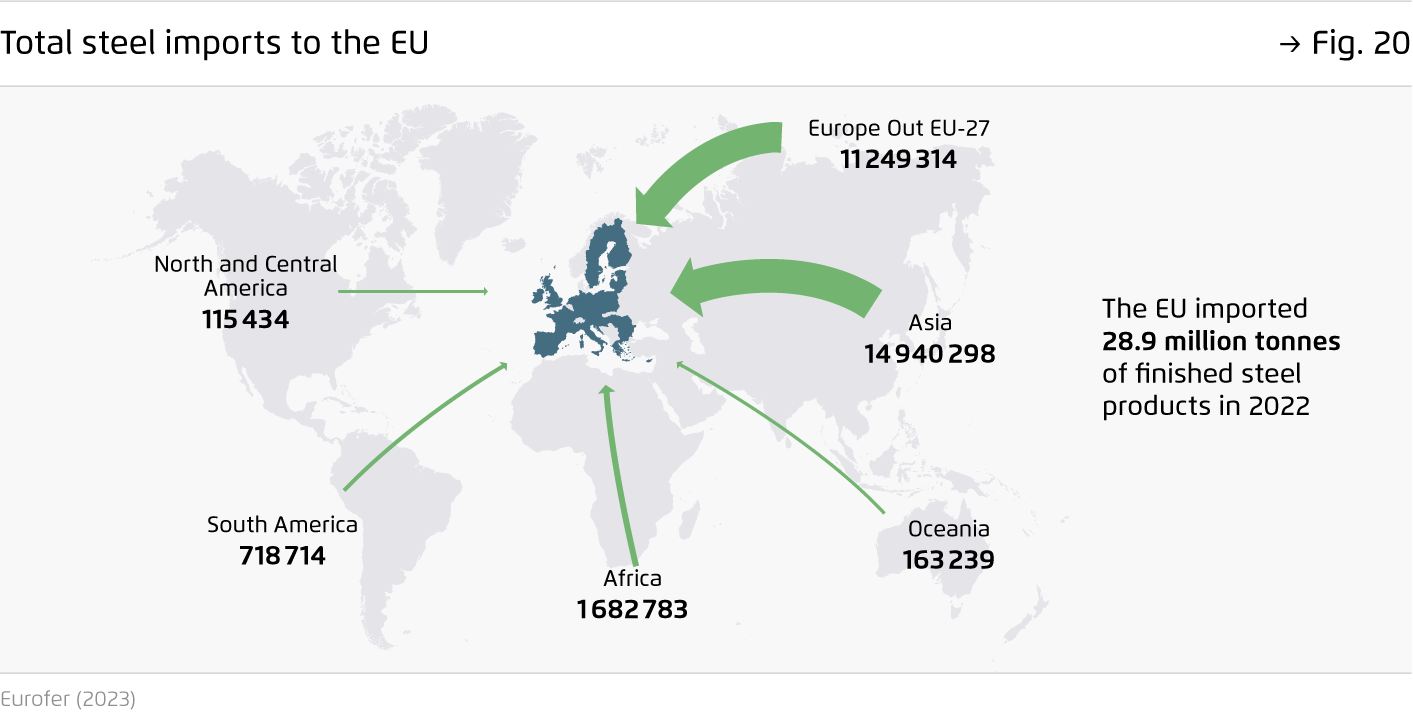

Two thirds of EU industrial greenhouse gas emissions come from steel, plastics, aluminium and cement. Decarbonising their production is crucial to achieve a climate neutral industry. In turn, 60 percent of these materials go into buildings, construction, packaging and mobility. However, market demand from these end-use sectors for climate neutral basic materials is currently insufficient, highlighting an important policy gap.

-

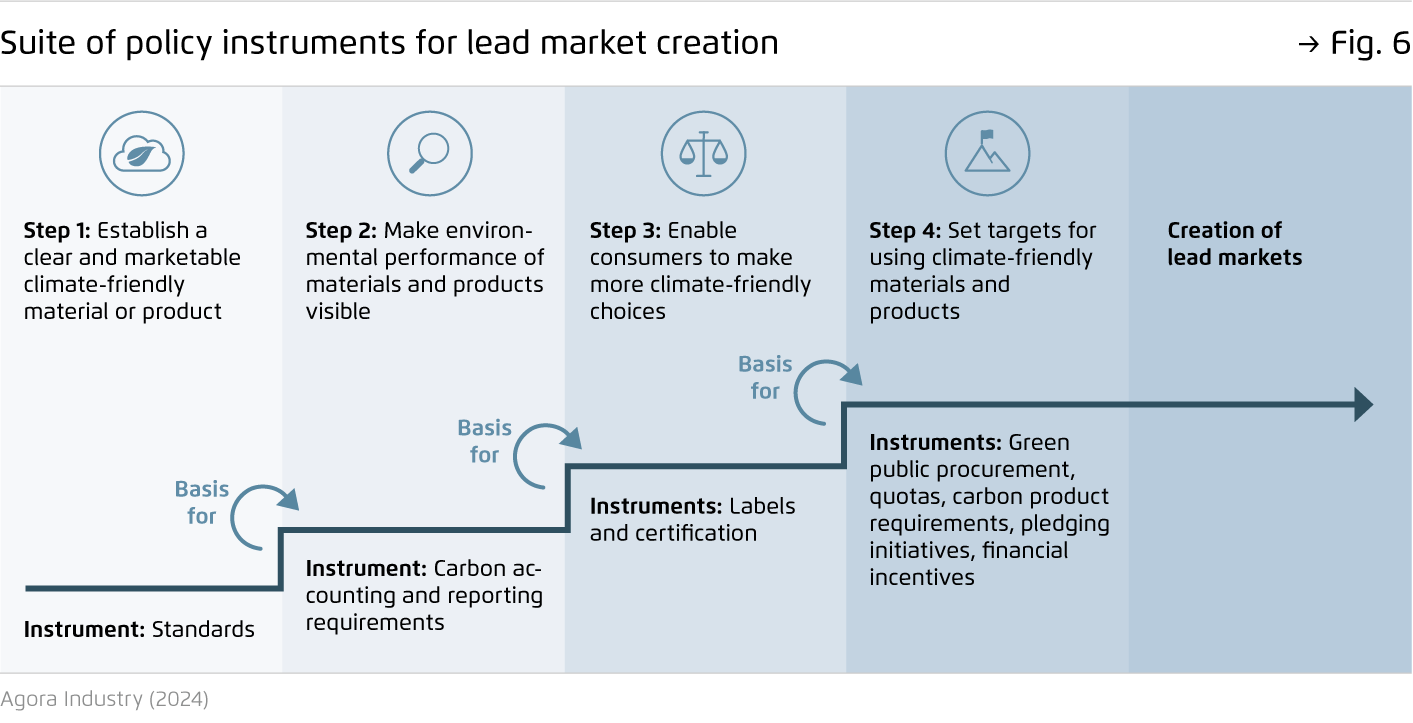

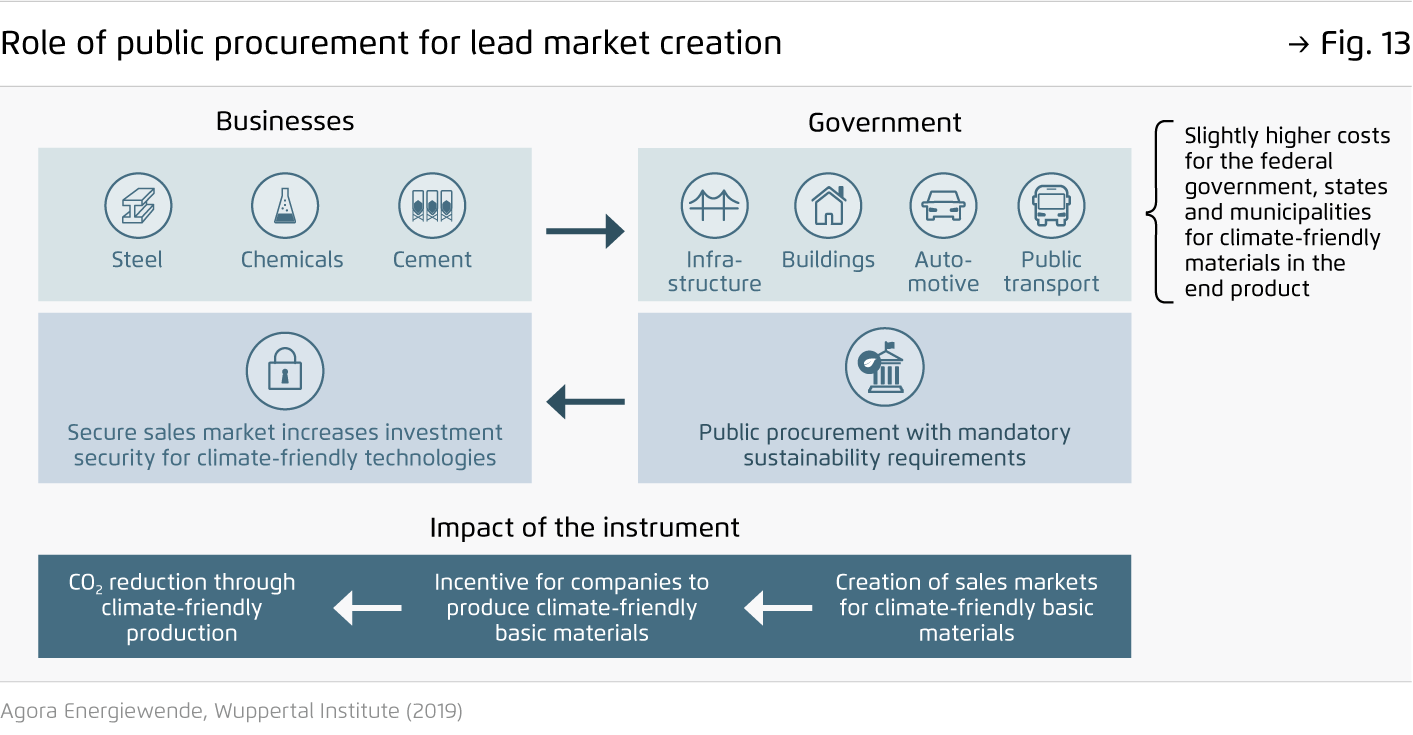

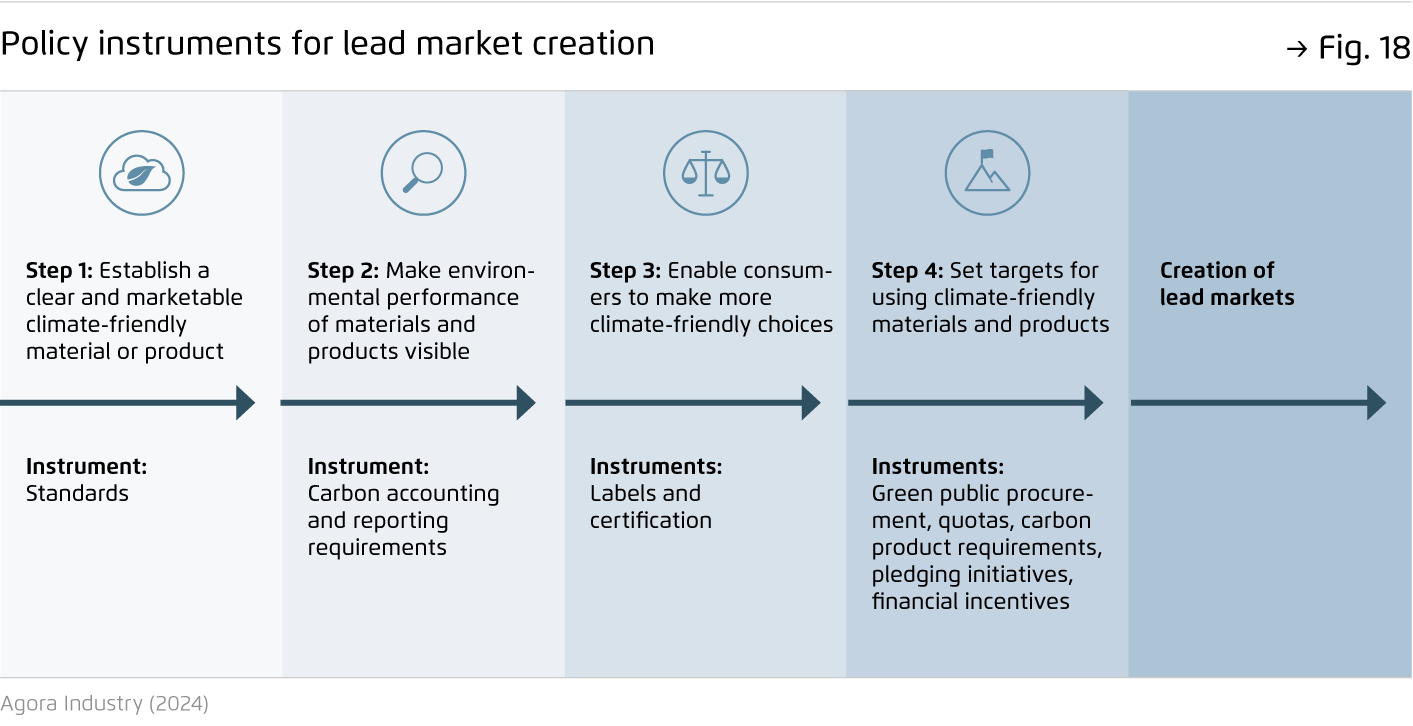

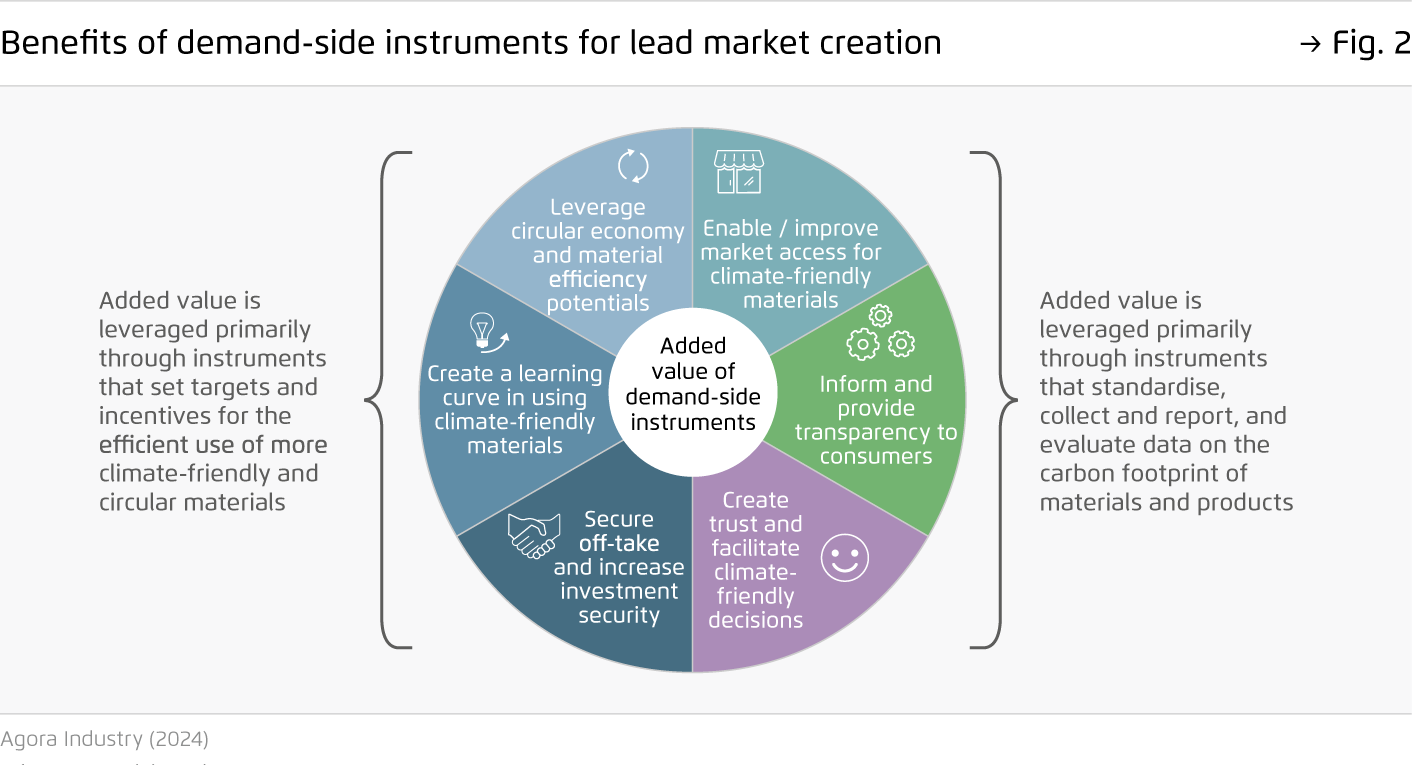

Lead market instruments combine a suite of policy instruments that jointly kick-start market demand for climate-friendly basic materials.

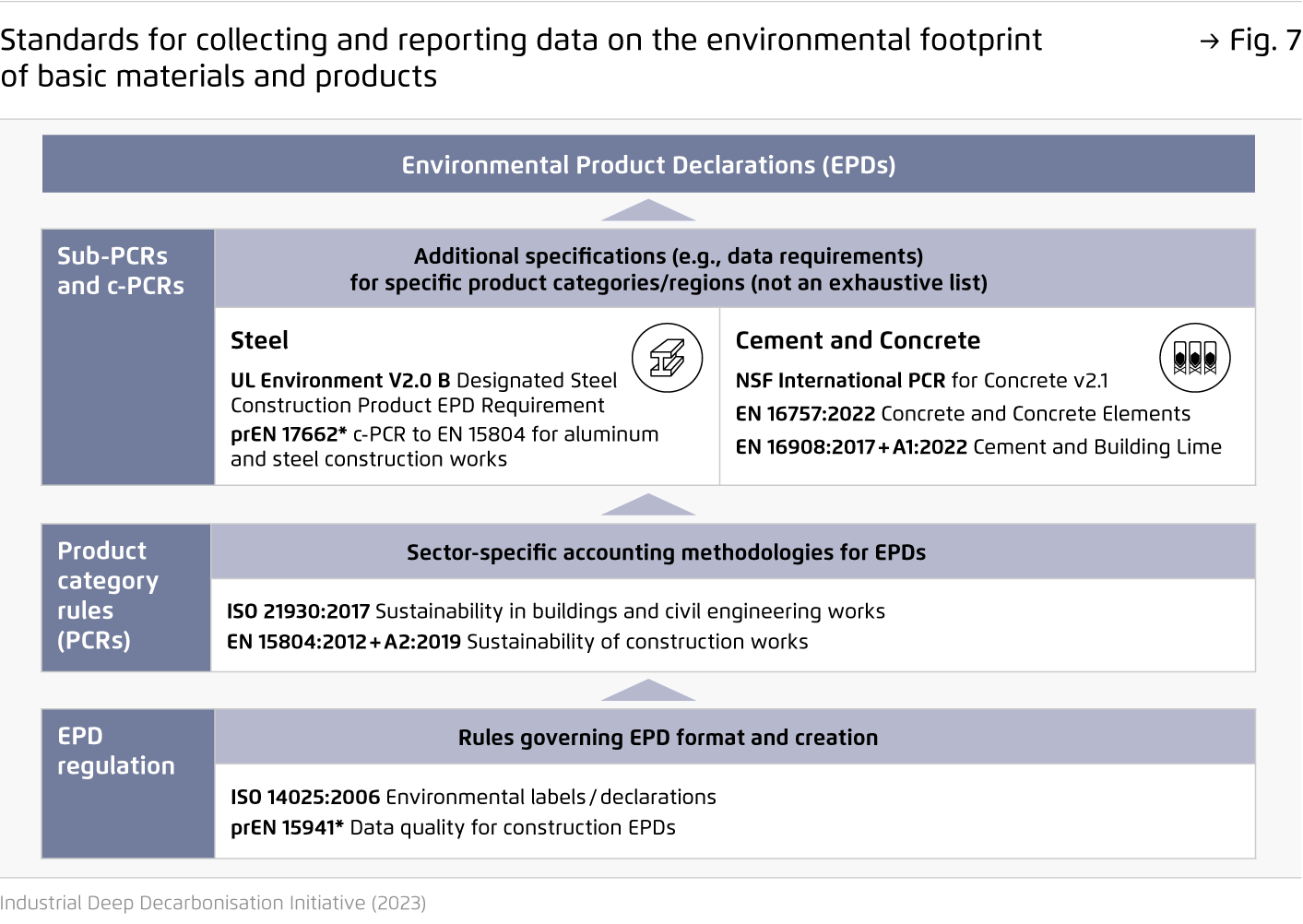

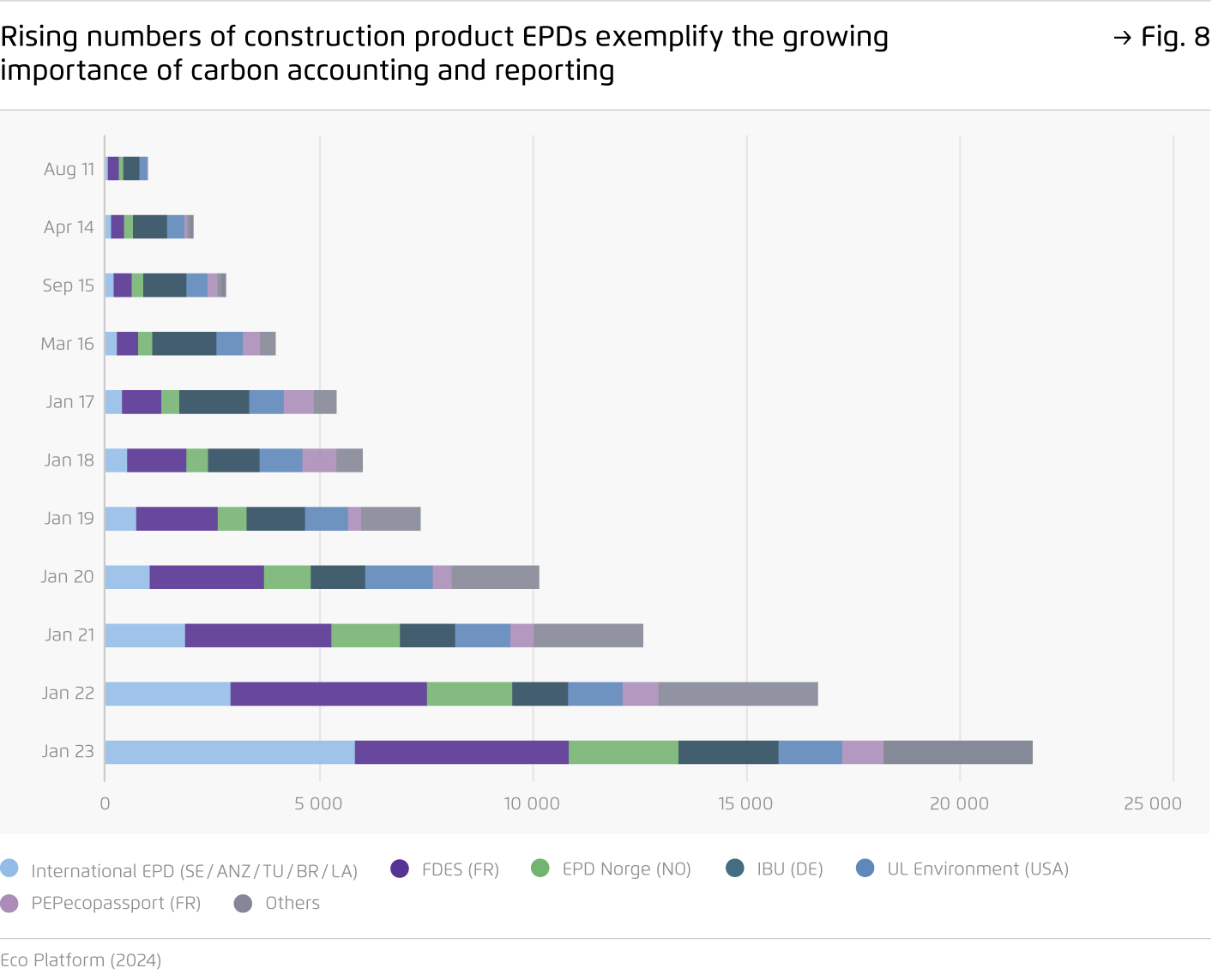

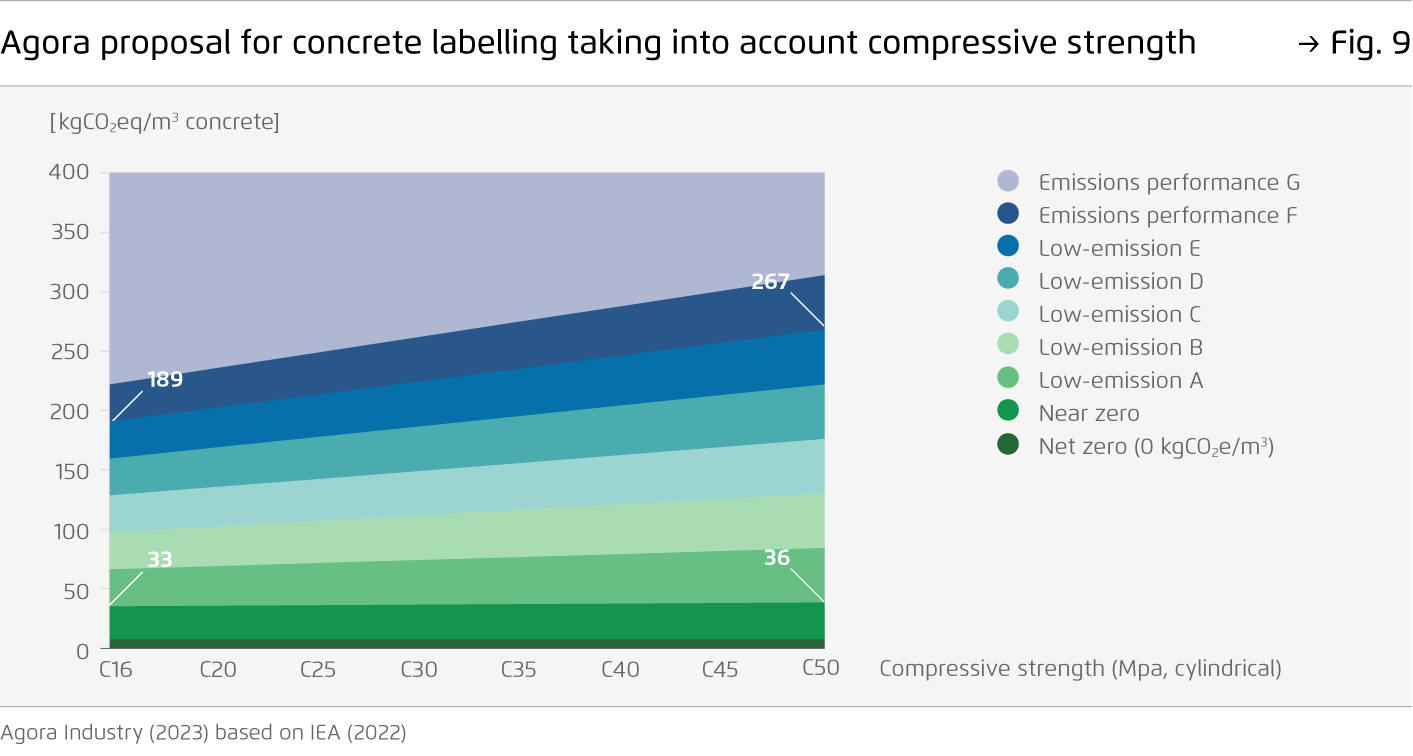

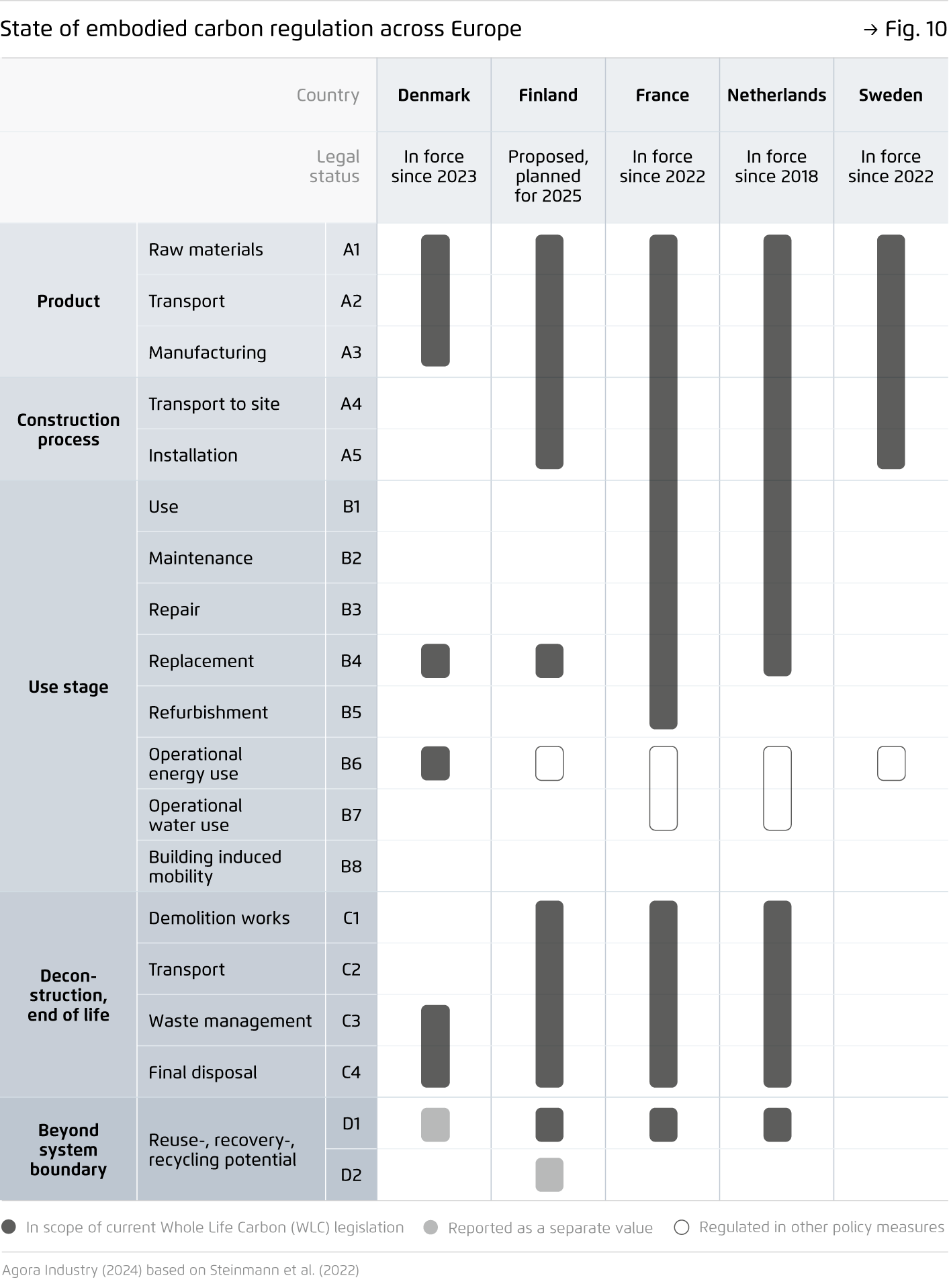

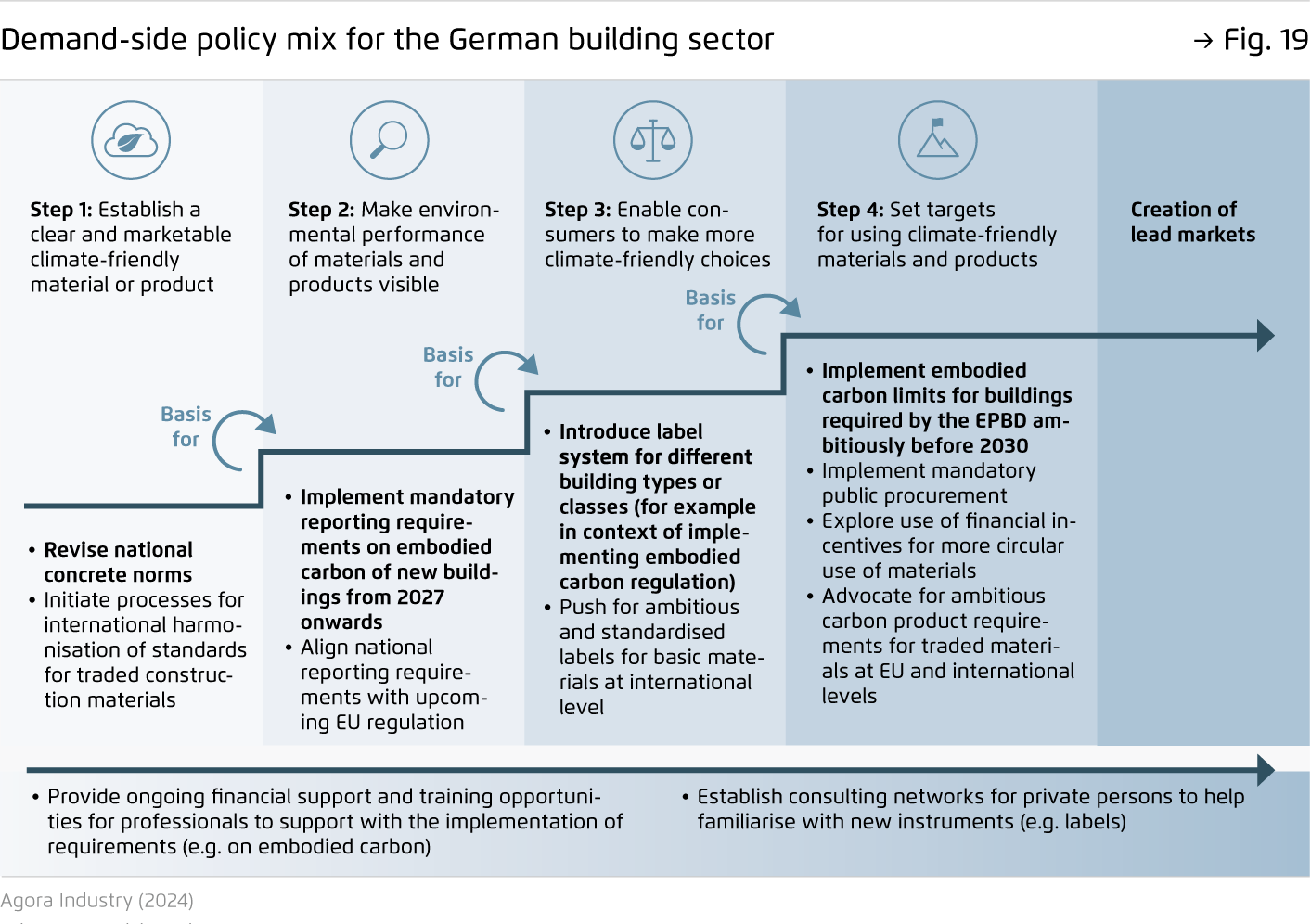

First, clear standards establish a distinct, marketable product. Second, stringent carbon accounting and reporting provide the required trust and transparency for businesses and consumers. Third, labels and certification enable businesses and consumers to make more climate friendly choices. Fourth, instruments such as green public procurement and embodied carbon limits create a specific market demand for climate-friendly materials.

-

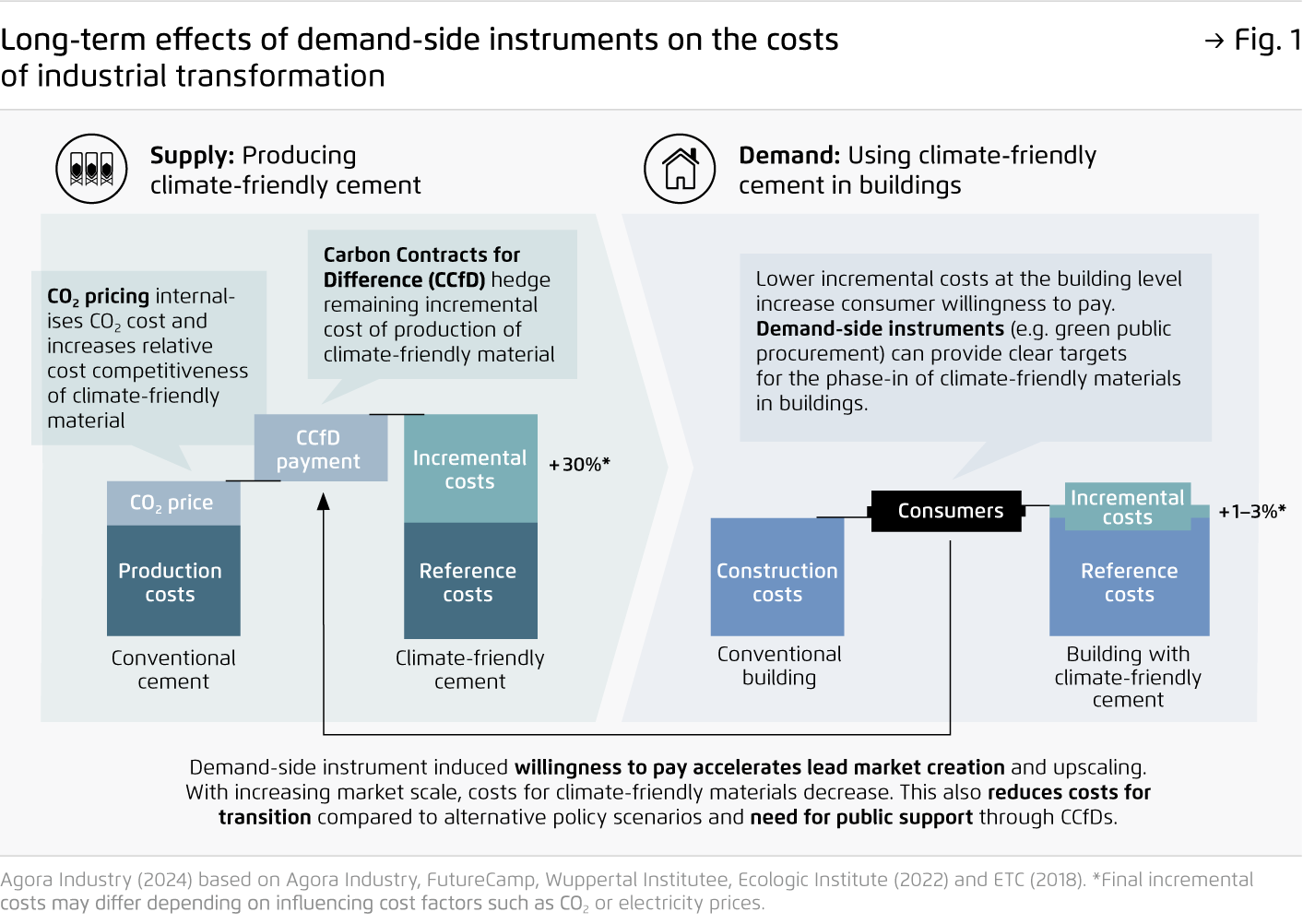

Using climate-friendly steel or cement increases the average cost of a building or car by only around one to three percent.

These marginal cost increases allow more consumers to make climate-friendlier choices and enable producers to recover additional costs directly from the market. This leads to a virtuous cycle: market growth becomes self-reinforcing and does not depend on direct government subsidies.

-

Buildings and construction are one of the largest demand sectors for basic materials and a key entry pathway for creating lead markets.

Basic materials going into the building and construction sector alone account for around thirty percent of overall industrial emissions in the EU. Upcoming EU requirements such as the revised Construction Products Regulation and the Energy Performance in Buildings Directive are first starting points for demand-side instruments. These need to be implemented ambitiously and complemented with additional instruments such as financial incentives for climate-friendly and circular materials.

This content is also available in: German

Creating markets for climate-friendly basic materials

Potentials and policy options

Preface

In the context of the industrial transition to net zero, market demand for climate-friendly materials is necessary for sectors with high upfront investment costs, such as steel, cement or chemicals. Strong market demand from end-use sectors can complement carbon pricing instruments, help de-risk early investments in climate-friendly production technologies and limit reliance on state subsidies.

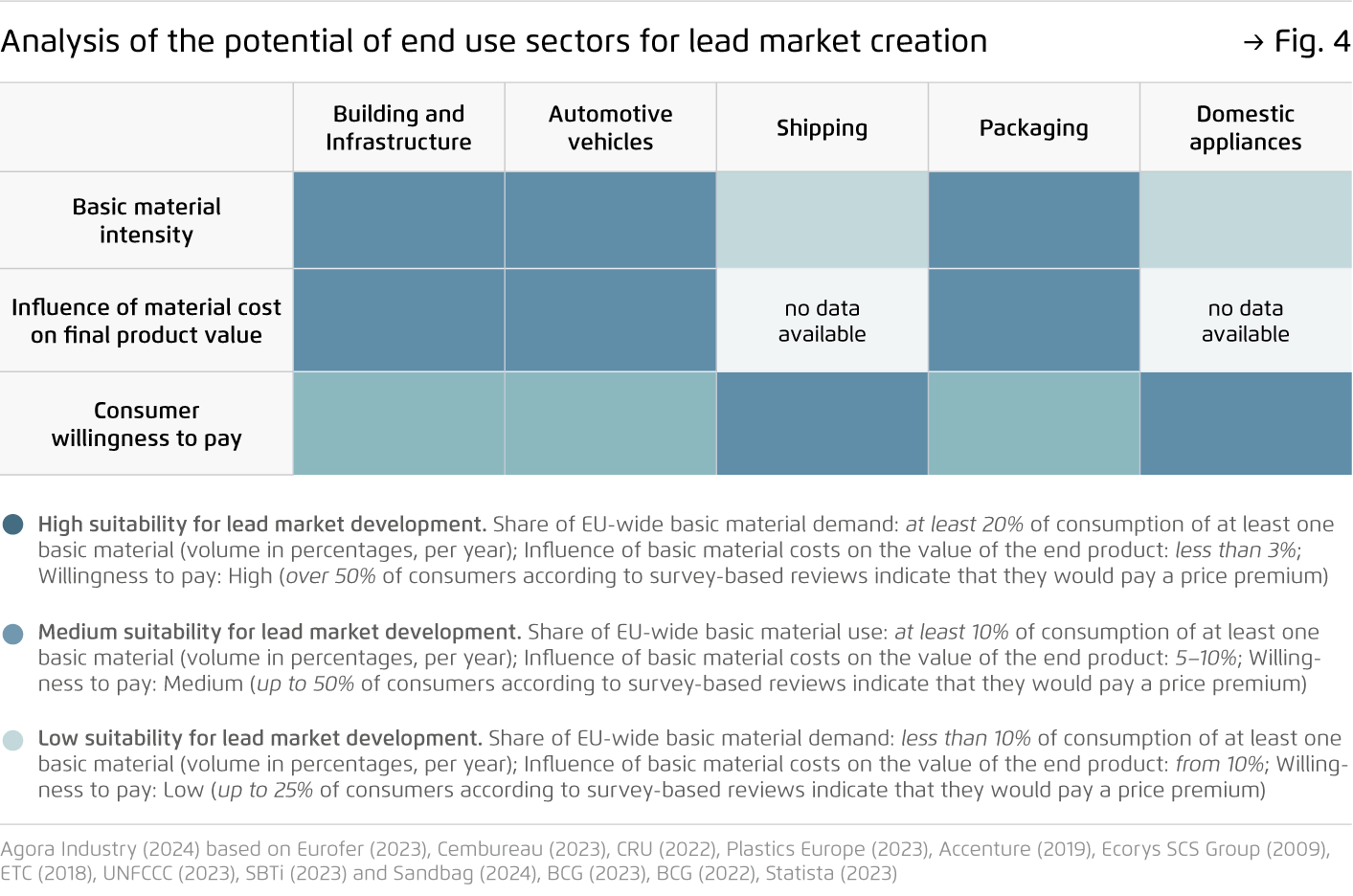

Necessary demand for climate-friendly basic materials can be activated by creating “lead markets”. Lead market instruments describe a suite of policy instruments that jointly kick-start market demand for climate-friendly basic materials – including standards, carbon accounting and reporting, embodied carbon limits and green public procurement. Each of these policy instruments has different effects, strengths and weaknesses. The optimal policy mix depends on the relevant end-use sector. Governments must take these factors into consideration when designing an effective policy package to support industrial transformation on the demand side.

Key findings

Bibliographical data

Downloads

-

Analysis

pdf 5 MB

Creating markets for climate-friendly basic materials

Potentials and policy options

All figures in this publication

Long-term effects of demand-side instruments on the costs of industrial transformation

Figure 1 from Creating markets for climate-friendly basic materials on page 9

Benefits of demand-side instruments for lead market creation

Figure 2 from Creating markets for climate-friendly basic materials on page 9

Our experts

-

Marie Westhof

Student Assistant Industry (until December 2024)