H₂ hotspots: Mapping the cost of green hydrogen production in Europe

Green hydrogen is an important piece of the puzzle in Europe’s efforts to achieve net zero. Finding cost-effective ways to produce this molecule will significantly influence its availability. A new Agora Industry tool shows which European regions can be most competitive when deploying additional wind and solar power facilities for the first wave of renewable hydrogen production by 2030.

Hydrogen is a potent fuel and an important feedstock for the production of numerous chemicals, steel and synthetic fertiliser. Renewable hydrogen can thus be a valuable commodity contributing to net-zero ambitions.

Countries with abundant wind and solar resources thus have a significant economic opportunity to become producers of green hydrogen for export or local use. To ensure sustainable investments, it is important to recognise that some sites will be much more suitable than others for the production of green H2 when the broader competitive landscape across Europe is taken into account.

Agora Industry’s new online tool shows where best to build hydrogen electrolysers directly connected to renewable energy generation facilities. Ideally, such projects would be designed to ensure that the electrolysers are optimised for use with the renewable energy facilities, and vice versa, to reduce production costs for green H2.

The Levelised Cost of Hydrogen (LCOH) map shows that while wind resources are more favourable in coastal plain areas around the North and Baltic Seas, solar PV performs best in Southern Europe. These hotspots could become renewable energy hubs supplying Europe with much of the electricity needed to decarbonise all sectors, including those few applications requiring green hydrogen.

The tool uses a model developed by Agora to reflect a number of local cost factors and provides high spatial resolution for optimal comparison of regions within countries and across Europe. Importantly, matching supply and demand means ensuring cost-effective delivery to off-takers elsewhere or attracting them to the regions where green H2 production costs are low.

Pipelines are usually the most promising option for transporting pure hydrogen across Europe, but industrial customers may also find it attractive to receive related molecules such as ammonia or methanol for direct use. European shipments of those hydrogen derivatives are likely to compete with rival producers overseas, where renewable energy may be even cheaper.

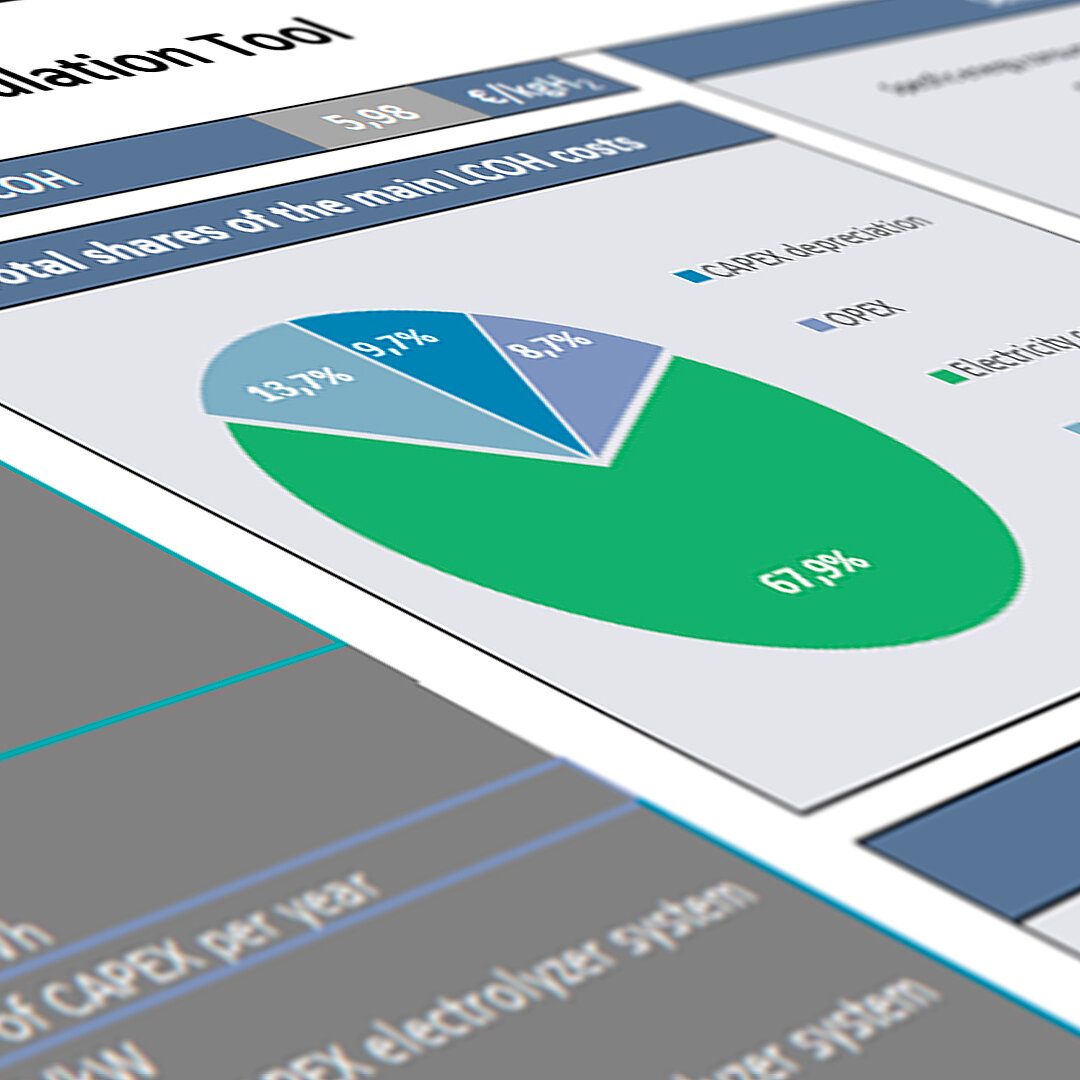

While the levelised cost of hydrogen provides a good indicator for broad analyses at the pre-feasibility level, it does not take into account all project implementation costs or expected profit margins. The recent European hydrogen auctions demonstrated that H2 costs are also affected by the way renewable energy is procured. In high-demand power markets, project developers may find it more lucrative to sell renewable electricity to the grid unless hydrogen producers match the market price. The actual price for green hydrogen on the market will therefore be higher than the projected production costs and depend on supply and demand dynamics. On the other hand, electrolyser costs are likely to come down in future, affecting the investments required to set up hydrogen production plants.

This new tool focuses on the short- and medium-term business model for green hydrogen production. It is foreseeable that, once energy from wind and solar start to dominate the electricity mix, producers will also be able to operate electrolysers more flexibly according to price signals from power markets. Declining prices for electrolysers and a market design that incentivises such a business model will further boost competitiveness.

In every calculation it is important to keep in mind that producing hydrogen from renewables will always be more expensive than using the same electricity directly, due to the energy conversion loss from electron to molecule. Whenever possible, the direct use of electricity should therefore be prioritised. No regret uses of green hydrogen include non-energy applications in industry, seasonal storage for backing up variable renewables in the power system, and long-haul shipping and aviation.

The Levelised Cost of Hydrogen map can be accessed below.